Budget is served for the fiscal year of June 2023 to July 2024.

The Board of Trustees approved the budget plan in October, later in the year than is typical.

Usually, the budget is balanced in June each year, but due to a substantial deficit and a new school president starting in July, the Board of Trustees granted an extension on the process.

“It’s a decision we don’t take lightly,” said Vice President of Finance Shelby Burke.

Since the COVID-19 pandemic, EvCC has seen consecutive years of decreased enrollment and increased operating expenses, as have many colleges across the country, said Burke. This has forced the administration to get creative with how they manage finances.

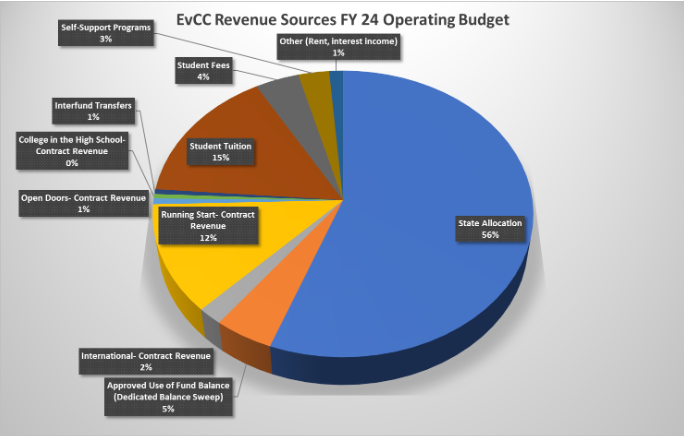

The school has two main budget pools. The first is the capital budget, sourced entirely from state grants. The second is the operating budget, just over half of which is sourced from state-allocated funds. Within the operating budget are the individual budgets of the college’s various programs.

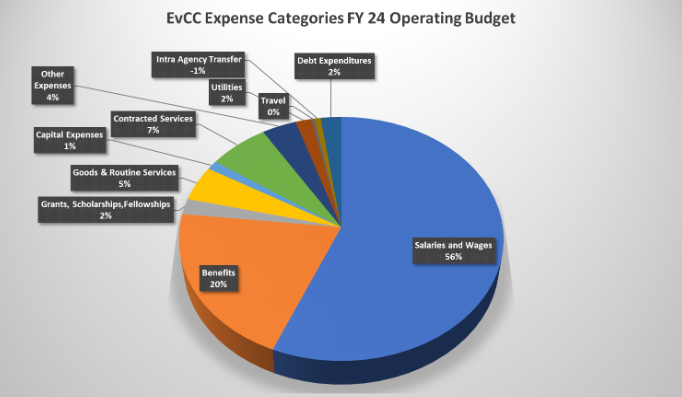

“The capital budget is primarily used for construction and renovation of physical infrastructure, while the operating budget is used for day-to-day expenses such as salaries, utilities and student services,” said Burke.

In previous years, the college has used a portion of its reserves to balance the budget. It functions almost like drawing from a savings account when one’s checking account is running thin.

“This is not considered debt, but it is not sustainable since our reserves would eventually run out if we continue this practice,” said Burke. “This is the third year the college has achieved a balanced budget largely through one-time solutions.”

Two such solutions last year were the sale of the Corporate and Continuing Education Center, located near Boeing, and the end of the school’s East County Campus lease in Monroe.

This year, the college enacted what it refers to as a sweep of dedicated fund balances to stabilize the operating budget.

A September memo shared with employees stated, “The leadership team and the president have decided to sweep $3.57 million from dedicated fund balances to help balance the budget. This reduced our deficit by about half to $3.4 million and reduced the impact of budget cuts on current staffing levels.”

Additionally, programs were asked to cut 10-15% of expenses to further stabilize the operating budget.

Even through all the financial turmoil, tuition has not been affected by the balancing of the budget. Tuition rates are set by the state Legislature, and this year they saw a relatively routine 3% increase.

“We factor that into our budget, but we do not set tuition rates to balance the budget. We have to find other ways to balance our budget, like increasing enrollment or cutting expenses,” said Burke.

While much has been accomplished already, there is still progress to be made moving forward.

“We are relieved to have it balanced, but we have more work to do to make sure it can be easier to balance in the future,” said Burke.

Work has already begun on the 2025 budget plan, with special focus toward sustainable, long term solutions and increased transparency on the part of the administration.

The college is currently offering employees voluntary separation incentive (VSI) opportunities. They are entirely optional, and the deadline to opt in is the end of the calendar year 2023. The VSI opportunities benefit the college in two distinct ways:

Since most employees are paid on a longevity based scale, the college will save money if someone higher on the scale leaves and is replaced by a new employee who starts at the low end of the scale.

If a given program has more employees than necessary to run effectively, their departure makes room for employees to be hired into other programs in greater need of staff.

Reducing the money paid to staff is the most effective way for the college to limit costs because 56% of the school’s expenses go to salaries and wages.

“The biggest downside to VSIs is that when long-term employees leave the college, there’s a loss of institutional history and knowledge,” said Vice President of Human Resources and Compliance Josh Ernst. “That being said, it also provides an opportunity for new ideas and new approaches from new faculty and staff who come on board.”

The aforementioned September memo concludes the matter succinctly.

“Keep in mind this very important point: We cannot continue paying for ongoing operating expenses out of our general reserve fund (our college rainy day fund),” the memo stated.

“EvCC continues to hover below the 25% threshold recommended by the State Board for Community and Technical Colleges that we need to hit for the fund to be at a healthy level.”